Change is not easy, especially when trying to change something about ourselves. And truthfully, most of us don’t try to improve ourselves or our finances out of the blue. There’s usually a specific reason, an event, or a guiding force that motivates us to change.

Maybe you just lost your job and realized your cash cushion isn’t as large as you’d like it to be. Or maybe it’s January 1, you’re riding the communal wave of self-improvement, and you decide this year you’ll build better money habits.

Another reason to add to the list? April is Financial Literacy Month. While it may sound like a made-up month (well, someone did make it up at some point), we’ll take it if it gives us another excuse to improve our finances.

Being financially literate is a crucial step in improving your money matters and understanding where your financial future is headed. Here are 4 ways you can begin to evaluate and find areas to improve your financial health, each in a different category of your finances (general finances, saving, credit, and spending).

1. Perform a SWOT Analysis (General Finances)

Before you dive into the nitty-gritty of your different financial accounts and documents, it’s best to start at a high level. An easy way to start this process is to answer the following question:

How would you describe your relationship with money? Understanding how you view and feel about money is important in addressing any underlying mental blocks or areas for improvement. Here are a few ideas to mull over so you can better answer that question:

- Is money something you avoid dealing with, talking about, or learning about?

- Does it make you angry or resentful?

- Is it a crutch for you? Something you think will rescue you from your problems?

- Are you completely disinterested in money?

- Is money something you feel unworthy of?

There’s no wrong answer. Just be sure to write down how you’d describe your relationship with money today—not what you wish it were. That way you can have a clear sense of what’s working and what may not be.

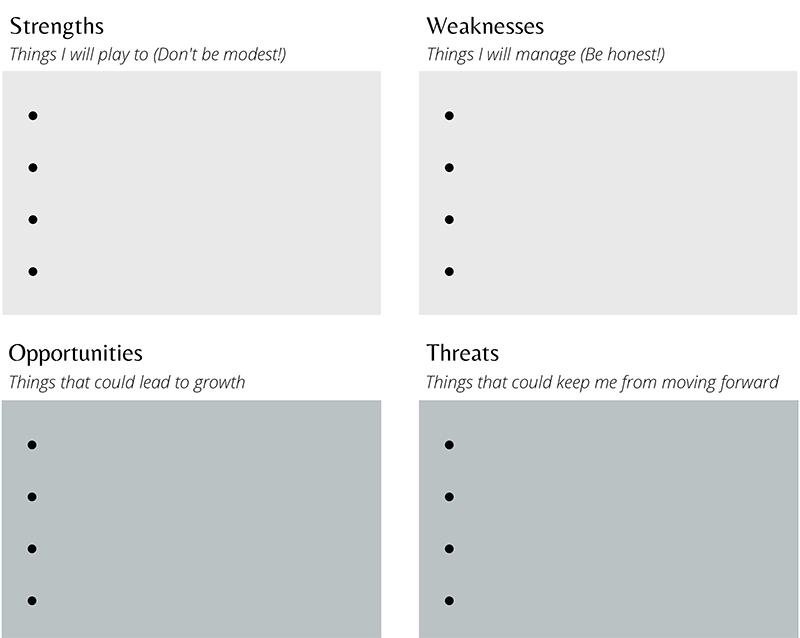

Next, perform what’s called a SWOT analysis, where you write down your financial Strengths, Weaknesses, Opportunities, and Threats. Here’s a simple chart you can use as a starting point:

Performing a SWOT analysis with the above template can help you learn more about where you are financially today and how you can get to where you want to be.

By giving yourself an opportunity to reflect, you can build a much stronger path forward for becoming the best version of your financial self.